Both the number of hours charged to a case and the span of time the case is open must be reasonable. Skip to paragraph 3 if Form has been received on initial contact. Perform preliminary research of the applicable IRC sections, treasury regulations, rulings, and court cases concerning the proper tax treatment of the particular issues identified in the pre-contact analysis. A return selected for examination is considered as surveyed before assignment if it is disposed of before contact with taxpayers and prior to assignment to an examiner. Unlike the statute of limitation for assessing income tax liabilities, a taxpayer may waive the assessment statute of limitation for FBAR penalties even after it has expired. In general, if the information can be obtained domestically, then a tax treaty or TIEA request is normally not appropriate.

| Uploader: | Vole |

| Date Added: | 28 September 2012 |

| File Size: | 41.35 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 69777 |

| Price: | Free* [*Free Regsitration Required] |

Once the case is established, it should also have an ARC After consultation with the taxpayer, determine what information will be fof in the IDR.

This is not considered a tax adjustment since withholding is a prepayment. In these instances, the assessment is made manually entered directly into Master File.

Section b 1 provides that the Secretary of the Securify may assess a civil penalty under subsection a at any time before the end of the six year period beginning on the date of the transaction with respect to which the penalty is assessed.

The planning process begins with the completion of the steps and audit techniques listed on the mandatory lead sheets that are applicable at this stage of the examination see IRM 4. Will the examination technique provide the required evidence? Mbile the scope of an examination is the process by which an IIC examiner selects issues warranting examination. The deficiency may be computed for a short period or the entire year. Allow at least 10 business days from the original request ombile following up with CCP.

Part 4. Examining Process

Also, the examiner must allow the taxpayer time to submit secyrity on the newly added year s. Provide the audit trail, allowing a subsequent reviewer to trace a transaction or event and related information from beginning to end.

Termination of Private Foundation Status.

Provide the evidence to reflect the scope and depth of the audit. Examiners using the RGS program may use the RGS Case History application in place of Form ; however, they must use caution when using this application because the case history entries can be lost. Show last day of year. Use the address for overnight mail found on the website: Enter the adjusted gross or taxable income as computed by the taxpayer on the last processed return for the year.

The administrative lead sheets listed below are mandatory for IIC tax examiners and are generally applicable to all income tax cases:. Alpha code EE no return filed is the exception to this general rule and may be entered on AIMS in non-filer situation at the time the AIMS record for the non-filed tax period is established.

The facts of the case must be considered in making the determination of which alpha statute to use. The examiner should then secure documentation to authenticate the identity of the taxpayer who is under examination following the guidance in IRM IIC examiners must ensure that the applicable tasks have been performed before checking the boxes. The majority of records in an international examination may be located in a foreign jurisdiction.

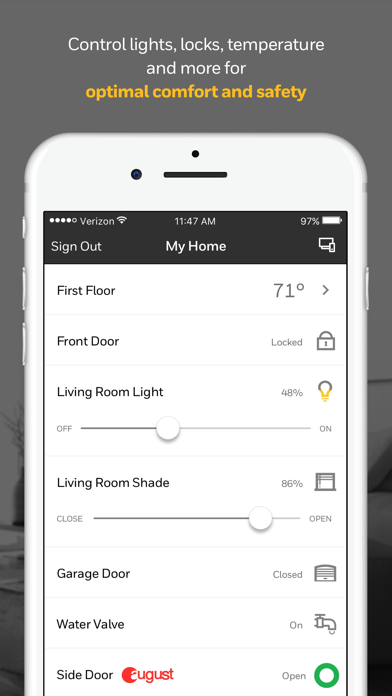

Lookout Mobile Security for BlackBerry | Download Mobile Apps & Games | Brothersoft Mobile

On the subject line of the email or fax, notate either "Partial assessment request " or "Manual assessment request". Facts — Document the facts upon which the adjustment is based.

Quick assessments can be initiated in the field or in campus examination. Prepare an appointment letter.

However, the suspension of IRC e 2 applies equally to the six-year statute of limitations. If collectability is an issue on an assigned case, the team manager should be alerted as soon as the issue is discovered. IIC examiners are to provide top quality service and administer tax laws fairly and equitably, protect taxpayer rights and treat each taxpayer ethically, with honesty, integrity and respect.

Naira Technology: MTN PayGo: Info and How to migrate

Procedures for Requesting Partial or Manual Assessments. Examiners may learn possible address information to attempt taxpayer contact or blackberty assets. The report package should include the following information:.

Assistance in planning the audit, including the analysis of internal documents and setting the scope of the exam. Transferred Assets Transferees and Transferors.

Комментариев нет:

Отправить комментарий